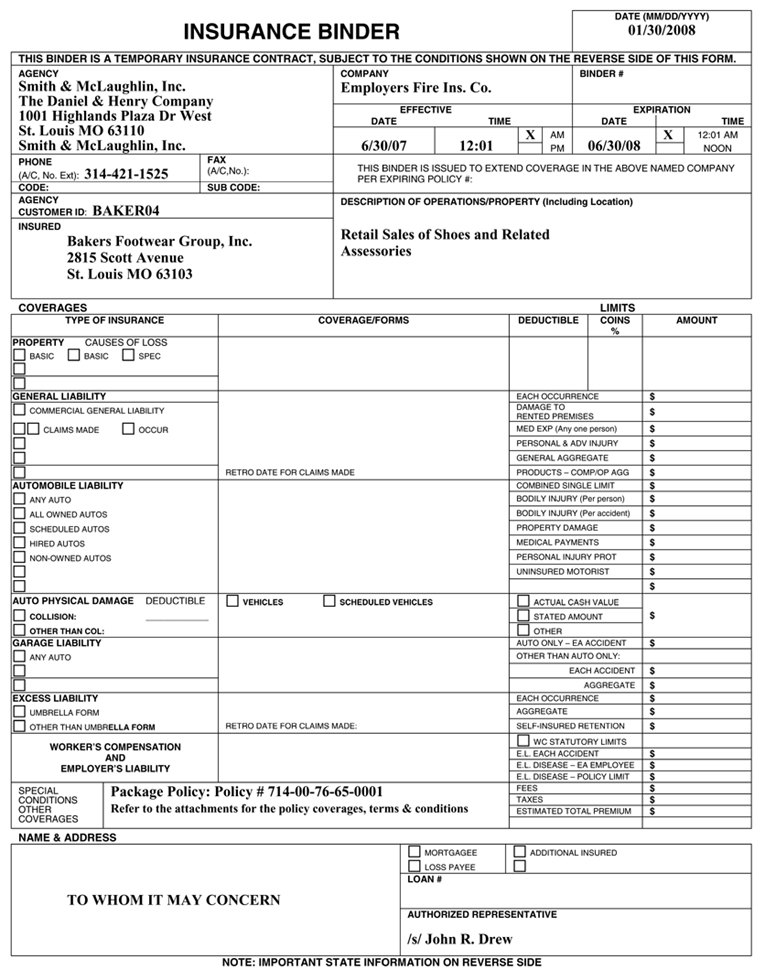

Car Insurance Binder Example

If you have any add ons or policy riders those will also be listed in your car insurance binder.

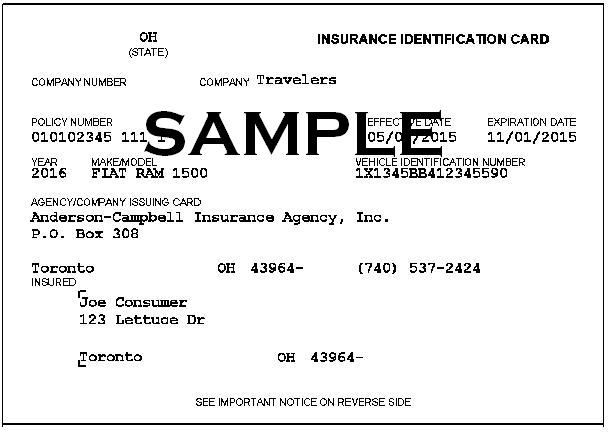

Car insurance binder example - An auto insurance binder letter is a way for you to have temporary car insurance coverage while the underwriting process is being completed by the insurer. How an insurance binder works. It serves as temporary proof of insurance or binding coverage until the full insurance policy is officially issued.

For auto insurance the insurer must give 5 days prior notice unless the binder is replaced by a policy or another binder in the same company. Edit download download. Except for auto insurance coverage no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days.

Keep in mind that the terms of the auto insurance binder letter are not necessarily the same as what your policy will be. Service lloyd s insura nce company. For example when closing on a house a homeowners or home insurance binder helps finalize your mortgage by providing temporary evidence of insurance.

Applicable in florida except for auto insurance coverage no notice of cancellation or nonrenewal of a binder is required unless the duration of the binder exceeds 60 days. Two of the most common examples of insurance binder use are in cases of purchasing a home or a car. Issuance of the insurance policy.

For example a binder may specify that you have 15 000 in liability coverage. Subject to the c onditions shown at the b otto m of this form. An insurance binder is a one page legal contract issued by an insurance agent or company that confirms the issuer s commitment to provide insurance to the named insured.

Car insurance binders include important information about your car insurance policy. Edit download download. A binder will act as your insurance until the underwriting process is through and your car insurance company issues you your actual policy.

From insurance binder to cover note. Fillable printable insurance binder sample. For a car policy you should see a description of coverages such as liability collision or comprehensive coverage with the associated deductibles.

For auto insurance the insurer must give 5 days prior notice unless the binder is replaced by a policy or another binder in the same company. The time it takes to finish underwriting policies varies but generally it should take around 10 days. A binder is issued when a policyholder wants or needs evidence of insurance coverage.

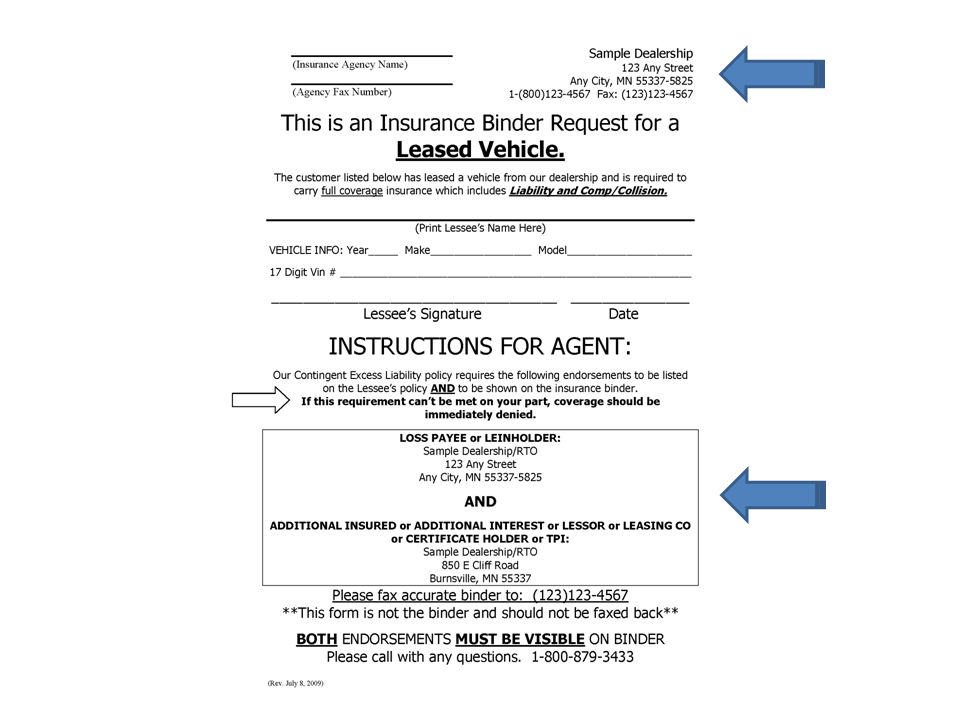

A car insurance binder is often used to prove that you have obtained insurance on your car and may be a requirement of a car dealership lease or finance company when purchasing a new car. For example say the owner of a landscaping business recently acquired a truck and has insured the vehicle under a new business auto policy the policy hasn t been issued yet so the owner needs a binder to register the truck with the state s motor vehicle department.