Life Insurance Estate Planning

Life insurance for estate planning.

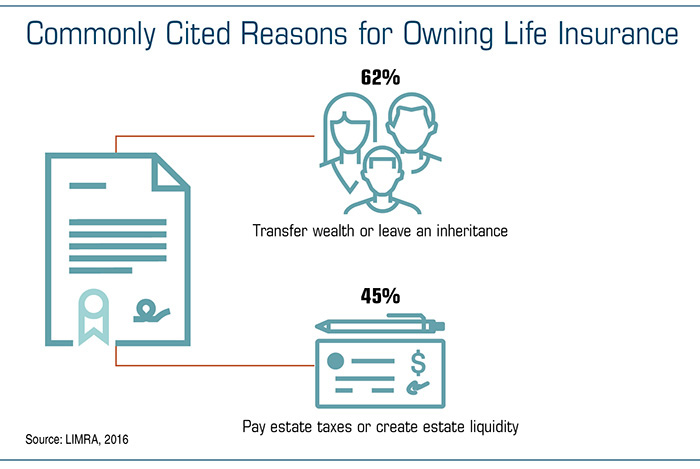

Life insurance estate planning - With proper planning insurance money can pay expenses. A life insurance trust if it successfully removes policies from the insured taxable estate will not subject a non citizen surviving spouse to qdot requirements because the policy proceeds pass. How much life insurance to buy for estate planning.

As the coronavirus pandemic continues the possibility of contracting the disease is forcing many people to take a closer look at their final arrangements including what life insurance policies and estate plans they may or may not have in place. Similarly the financial position also plays an important role. Glenn has lectured and written extensively on the subjects of estate planning taxation and life insurance.

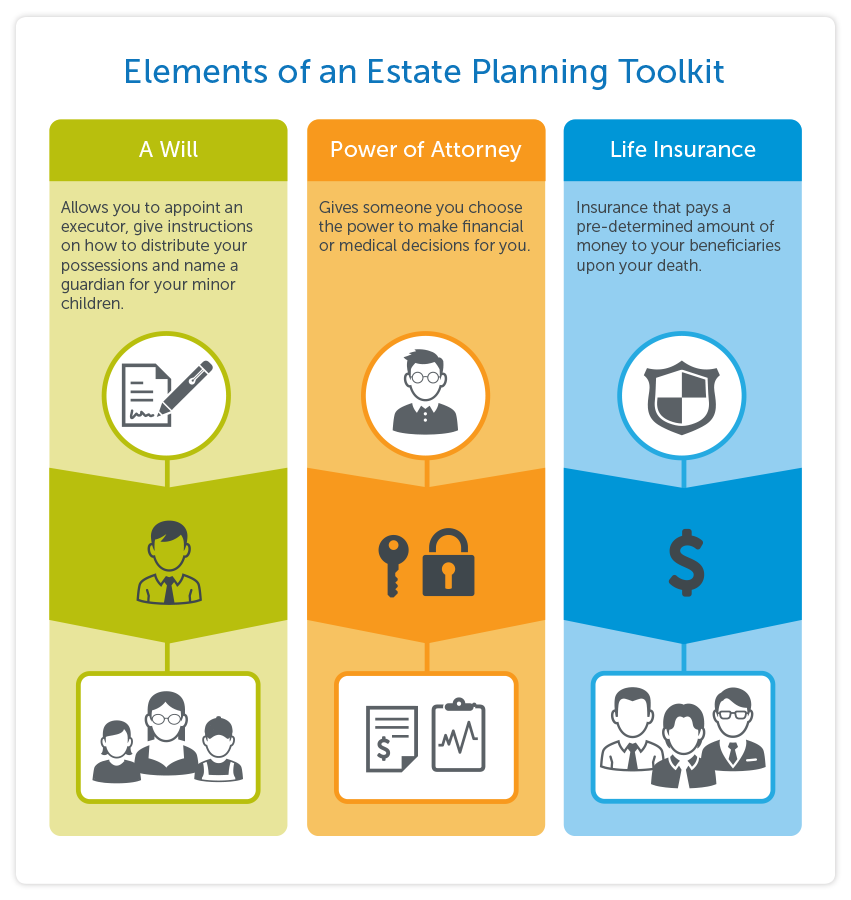

The fact is having life insurance and an estate plan is something every person should have regardless of the current public health emergency so. A life insurance policy can serve several estate planning purposes at once and the trend of falling prices for life policies has made life insurance an even more attractive part of an estate planning strategy. Glenn is a member of the society of trust and estate practitioners step the conference for advanced life underwriting calu and the canadian tax foundation.

Consequently life insurance can be a valuable element awaiting completion of the probate process. As part of the estate planning process you may talk to any number of advisors from lawyers accountants and trust officers to financial and retirement planners these advisors often provide not only valuable services but also may be in the business of selling investments annuities and insurance. Life insurance may play a vital role in an estate plan because insurance proceeds can be counted on to provide liquidity when it s needed.

Also known as a survivorship life insurance policy it is typically cheaper than a whole life or universal life policy on an individual paying out the face amount of the policy upon the death of the second spouse. The cash payment from life insurance can be used to provide liquidity to a family when they need extra time to sell real estate holdings or a family owned business. The amount of life insurance coverage that one can buy for estate planning purposes depends on the size and estate goals.

He is a regular columnist for forum magazine and an editor of clu comment. Life insurance can also be used to protect a family from a large estate tax bill. But life insurance also serves a critical role in the family s estate plan.

One key element in estate planning is the addition of life insurance.