Life Insurance Needs Approach

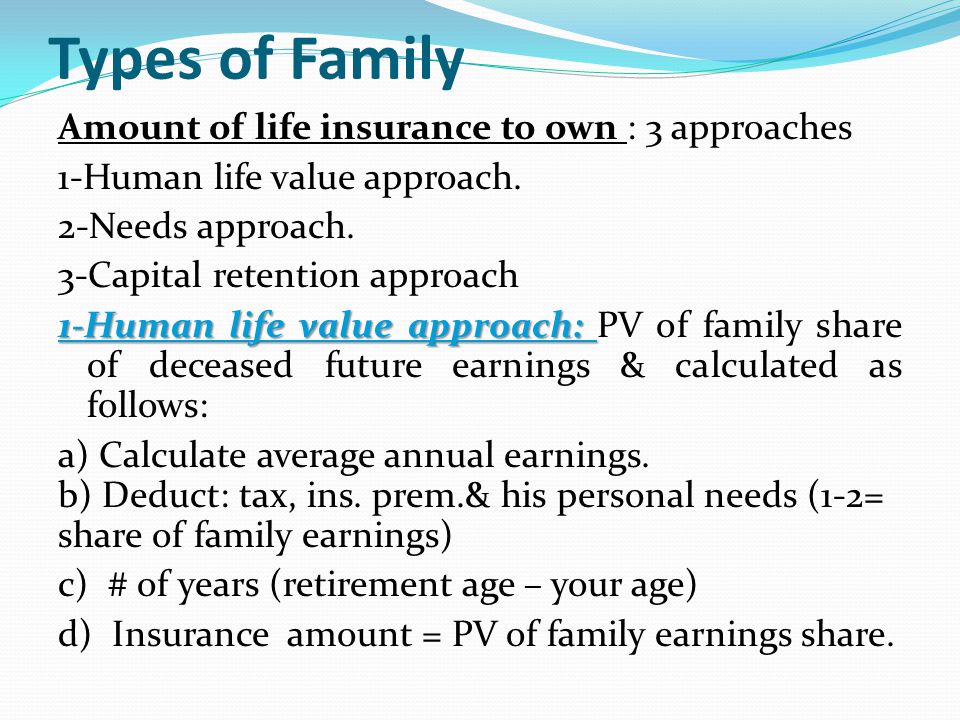

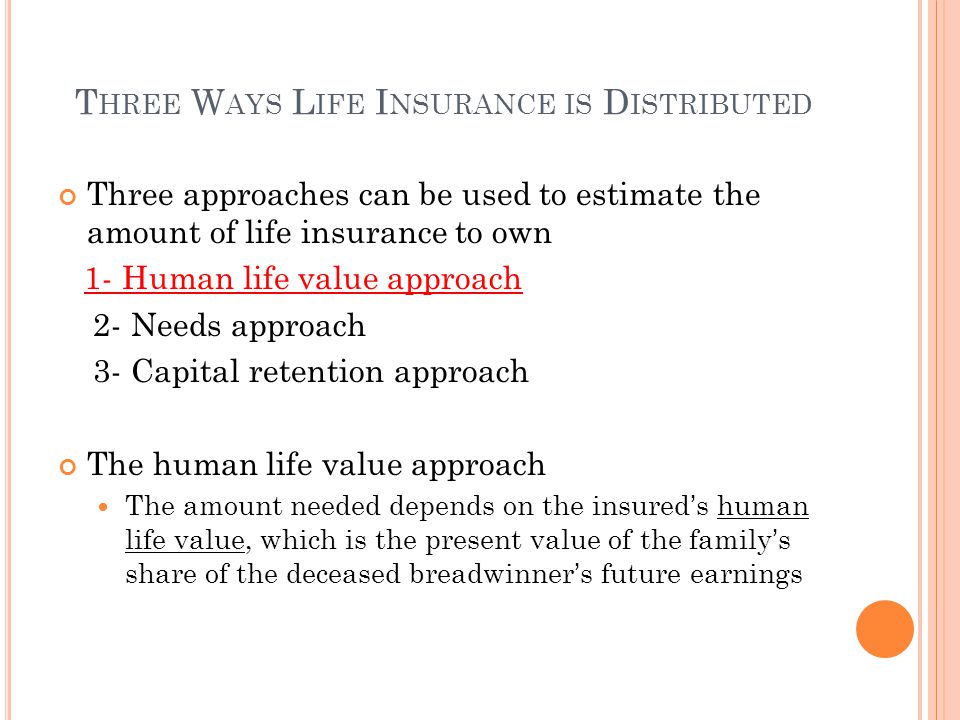

The human life approach is a method of calculating the amount of life insurance a family would need based on the financial loss they would incur if the insured person in the family were to pass.

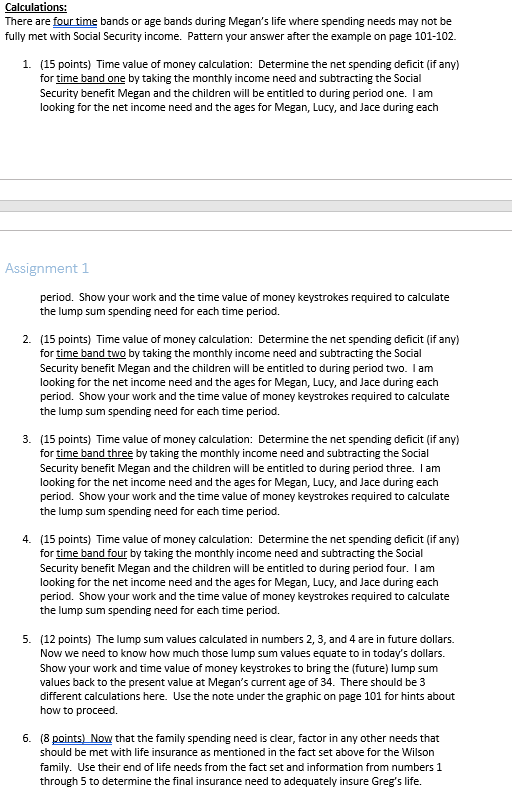

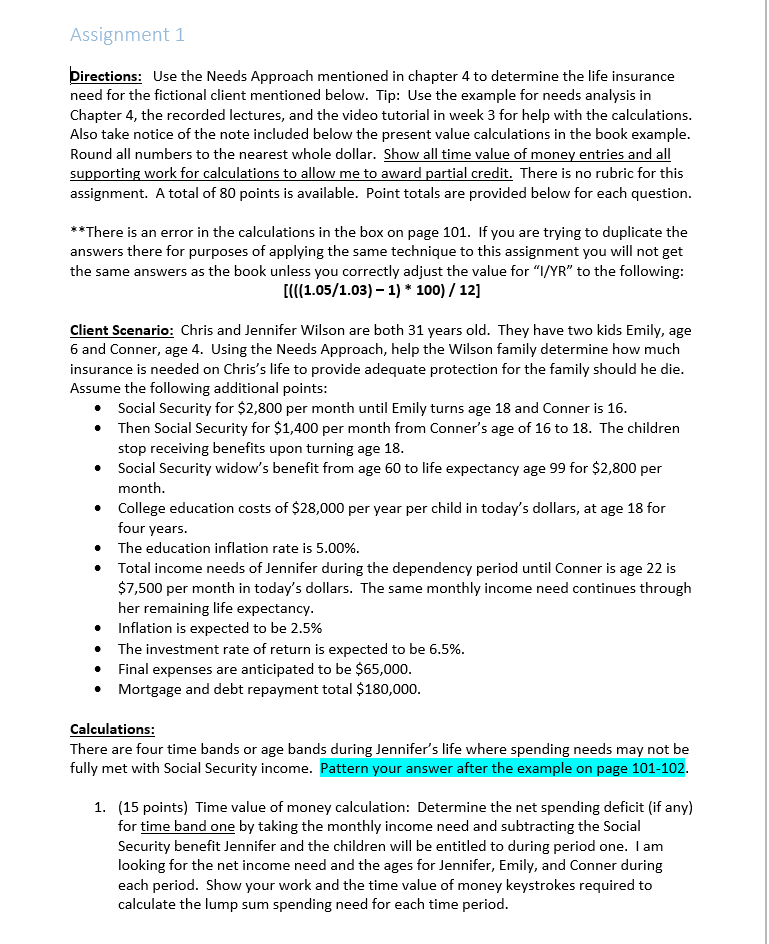

Life insurance needs approach - Life insurance coverage needs change with the time therefore it is important to review your insurance needs regularly. Under this approach the insurance purchased is based on the value of the income the insured breadwinner can expect to earn during his or her lifetime. To estimate how much life insurance you need using the needs approach you should add up all current and potential expenses and then subtract the total amount of.

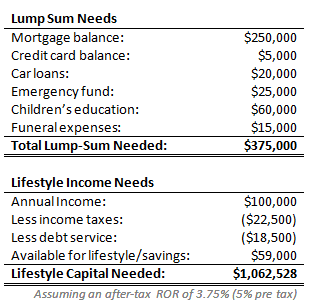

The goal of this approach is to replace the primary breadwinner s salary for a predetermined number of years. Your life insurance premium should be rs 40 000 6 500000 1 500000 2. For example you estimate an insurance need of 800 000 for the 30 years of your surviving spouse s life expectancy using the family needs approach.

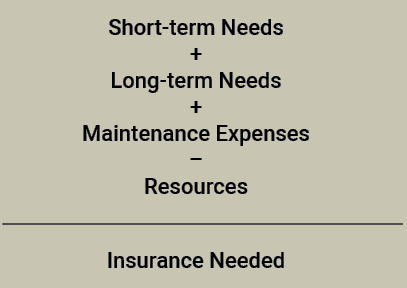

The needs approach is a function of two variables. The needs approach method is based on life events most people experience and protecting those events from financial loss using life insurance. How much money is necessary at the time of death to meet obligations and how much future income is needed to sustain the household without falling into.

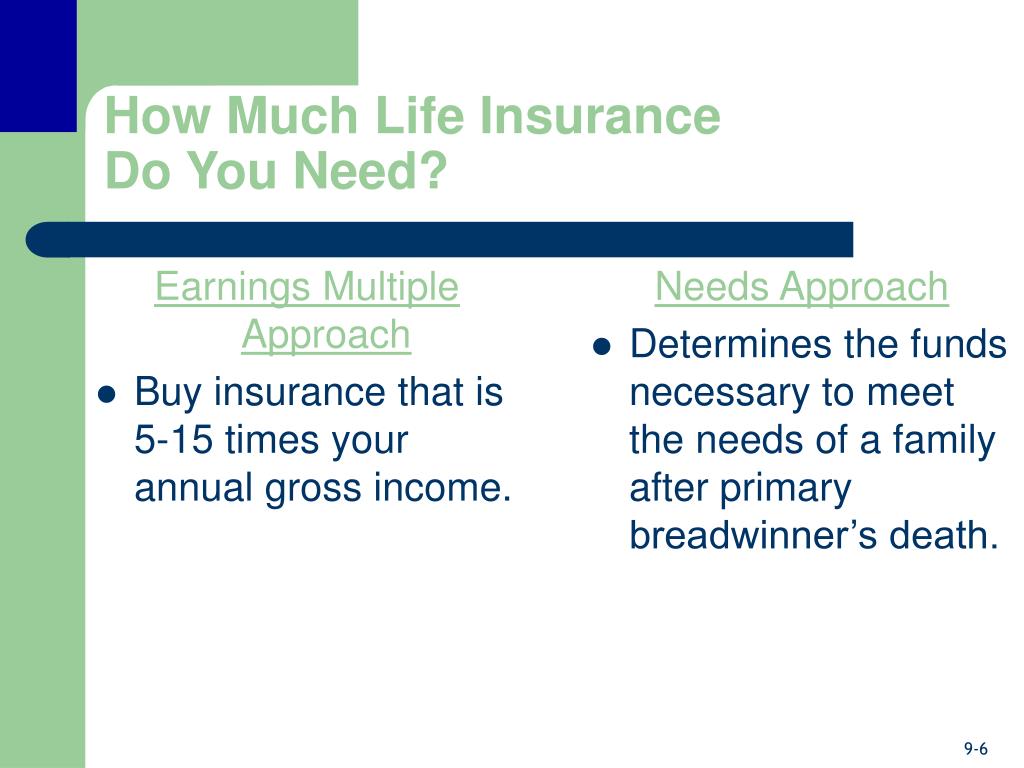

The needs approach is one of the most accurate methods to determine the amount of life insurance to own. Say your gross annual income is rs 5 lakh and you have two dependents your wife and child. Life insurance needs can change over time and after major life events so it s important to review your policy regularly.

If you use the capital liquidation approach you can settle for somewhat smaller insurance proceeds because you won t depend entirely on the investment returns for the 800 000 need. It takes into account all the present and future family needs and calculates directly the amount necessary to meet those needs. By focusing only on a family breadwinner s expected future earnings stream the human life value provides a fairly rough estimate of life insurance needs.

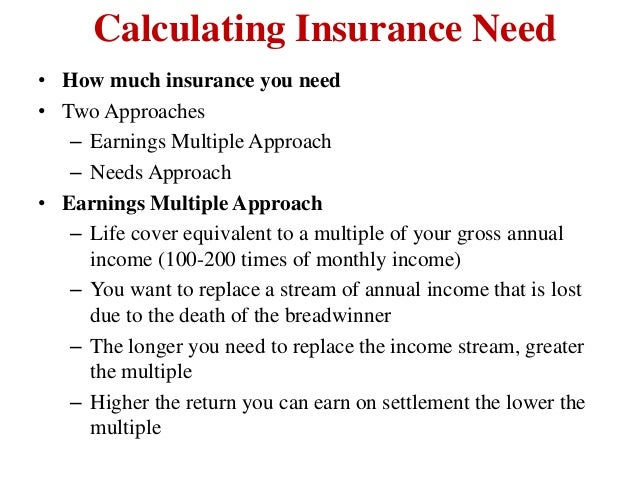

The simplest method for estimating your clients life insurance needs is the multiple of income approach. This approach is based on the creation of a budget of expenses that will. Independent life brokerage sources generally maintain life event lists for annual reviews which i highly recommend.