Life Insurance Table

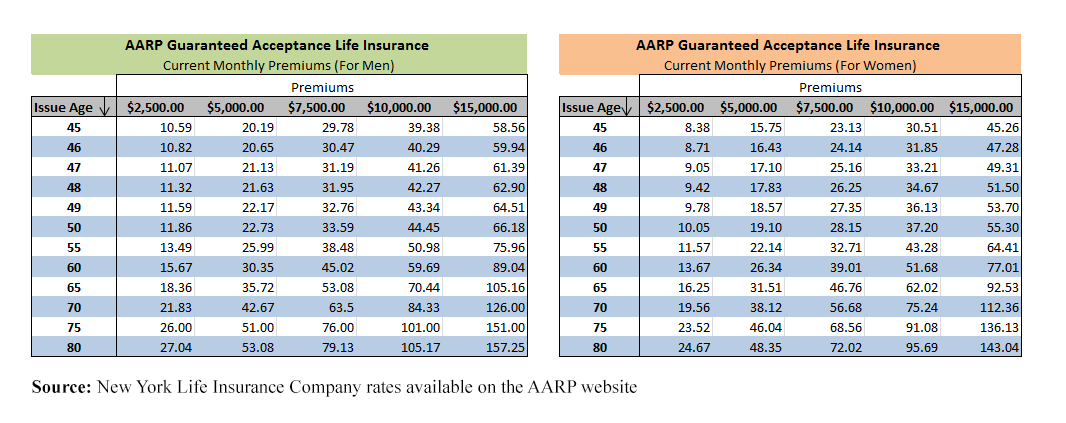

Life insurance companies will use age as a determinant for life insurance premiums.

Life insurance table - If you recently applied for a life insurance policy and were told that your risk factors put you into table rating territory there is a good chance that you have no idea what that means. When you have a health issue adverse driving record drug and alcohol abuse history or occupation avocation that increases your risk a table rating may be required. Monthly rates are for informational purposes only and must be qualified for.

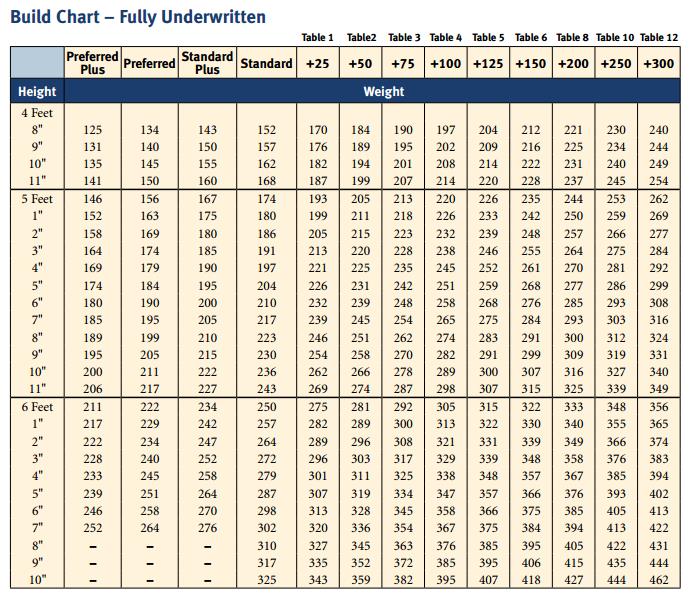

When an applicant for life insurance fails to qualify for one of the standard underwriting classifications he or she is typically subject to being table rated. An actuarial life table is a table or spreadsheet that shows the probability of a person at a certain age dying before their next birthday and is used by insurance companies to price products. What are life insurance table ratings and how do they work.

We now discuss the substandard life insurance tables i e. These are the ratings you hear about. He is an independent life insurance agent that works for his clients nationwide to secure affordable coverage while making the process.

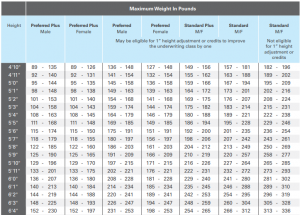

Applicants who are table rated will pay an extra fee on top of the standard life insurance premiums they would normally be charged. How the substandard life insurance tables work. Life insurance table ratings are used by the insurance company underwriting departments to assess the risk you present when they offer you a life insurance policy.

The following sample whole life insurance quotes are based on a preferred plus female wanting ordinary whole life insurance to age 100 with an a rated insurance company or better. Life insurance table ratings. After this group carriers have substandard life insurance tables for people with increased health risks.

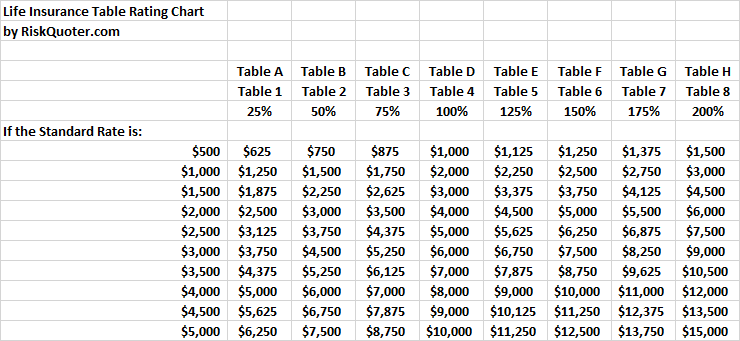

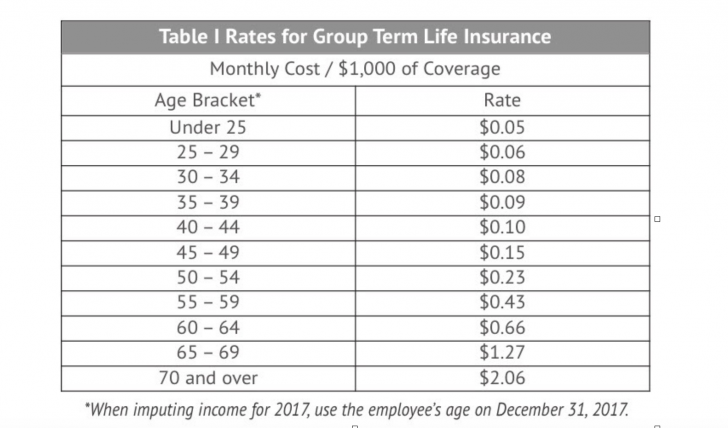

You ll skip the medical exam in exchange for higher rates and lower. Table ratings are numbered 1 16 or lettered a p with each grade adding 25 to a standard rate. The basic premise behind life insurance is that insurers calculate the odds of a person dying and then price life insurance coverage based on those risks.

The term life insurance quotes below are for a 20 year term life insurance policy with a death benefit of 500 000. If you have any medical or health issues work in a dangerous occupation have an adventurous lifestyle or any combination of these factors these all increase the risk associated. Rates will continue to increase as you age due to a decrease in your total life expectancy.

Depending on the carrier they are tables a through h or 1 through 16.