Life Insurance Underwriting Process Steps

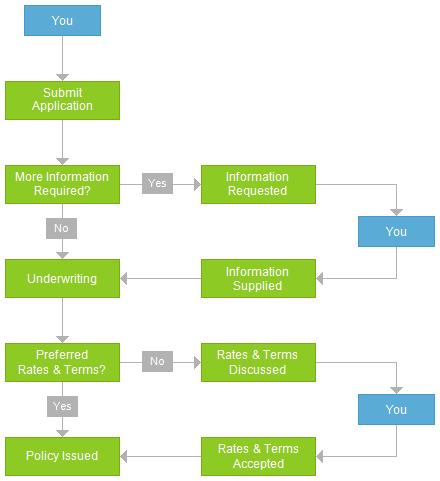

Before life insurance underwriting even begins the carrier will go through your application to make sure all of the correct information is there.

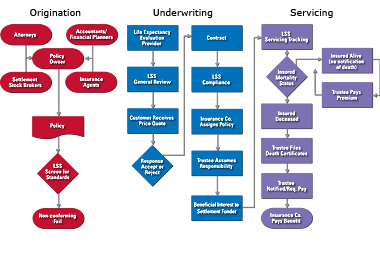

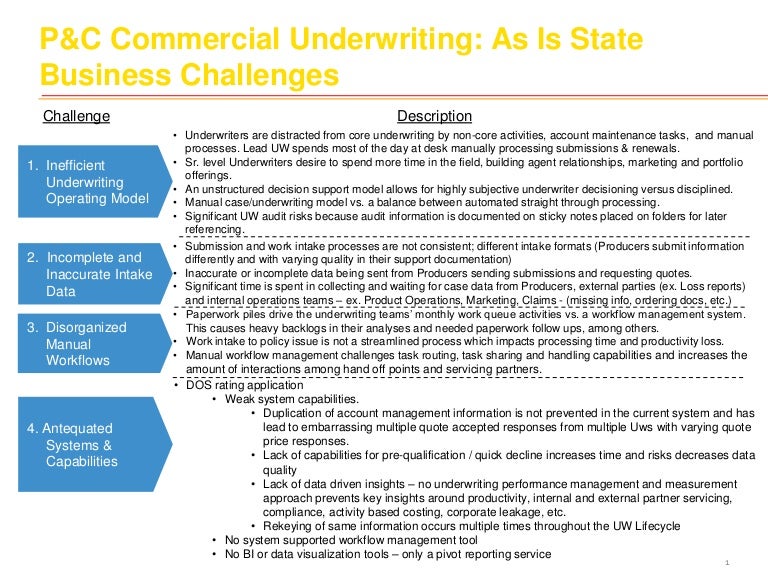

Life insurance underwriting process steps - The underwriting process is an essential part of any insurance application. Underwriting is the process of evaluating an insurance application that involves determining an applicant s risk by reviewing his or her medical information financial information and lifestyle. Life insurance companies use underwriters to look at the information gathered about you and then figure how much of a risk it would be to sell you.

This involves finding out key details about you and is carried out by an insurance underwriter. Please view the list of carriers and their respective maximum face amounts to be eligible for no medical exams. Insurance underwriting is the name given to the process of assessing your life insurance application.

An insurer has a responsibility to its current policyholders to make sure that it will be able to meet all the contractual obligations of its existing policies. When an individual applies for insurance coverage he or she is essentially asking the insurance company to take on the potential risk of having to pay a claim in the future. Accelerated underwriting speeds up the process at no extra cost by avoiding some of the more rigorous medical steps aps requests or medical exams.

Many accelerated underwriting life insurance plans cap out at 1 000 000 in coverage. It may be longer than that if your potential insurer has questions or if they need to. It s not uncommon for applications to be accidentally incomplete.

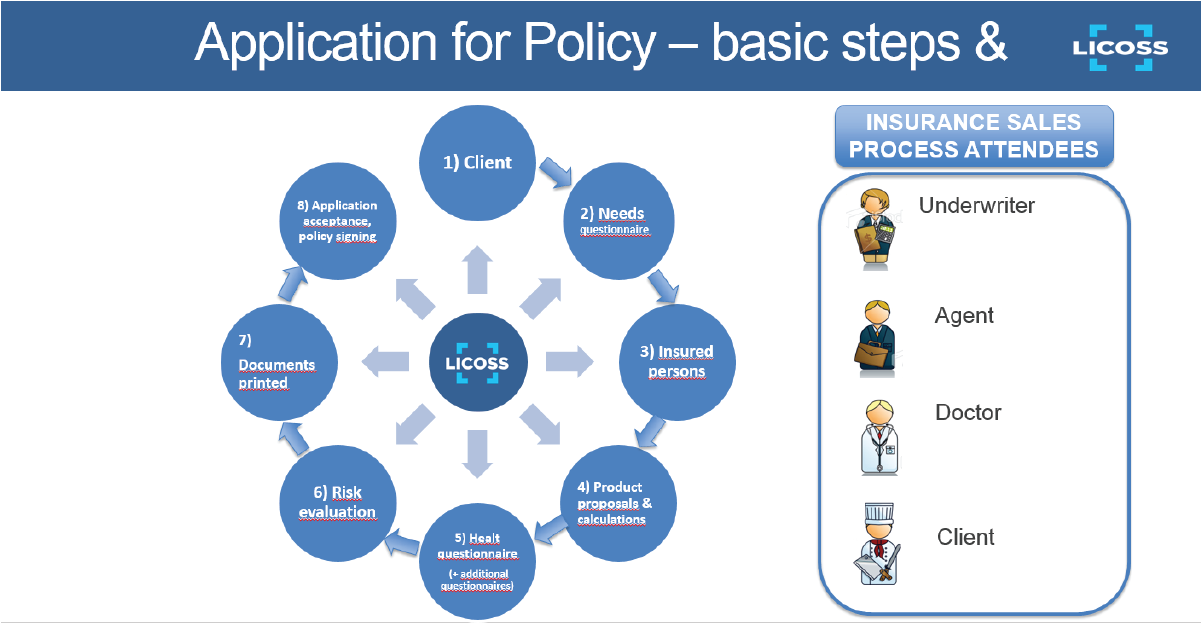

Insurers cannot accept every applicant. Applying for a life insurance policy is easy. Your application is the first step in actually getting life insurance so it s something you want to get right.

You will be required to take a paramedic examination at the insurance company s expense and the insurance company may request a copy of your medical records as well as information from the mib. Especially when applied for online it may take only a few minutes. When you apply for a life insurance policy your application goes to the insurance company s underwriting department where the process begins.

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)