Long Term Disability Insurance Quotes

With extensive base benefits and a large selection of additional coverage options long term disability insurance can provide income replacement in the case of unexpected sickness or injury.

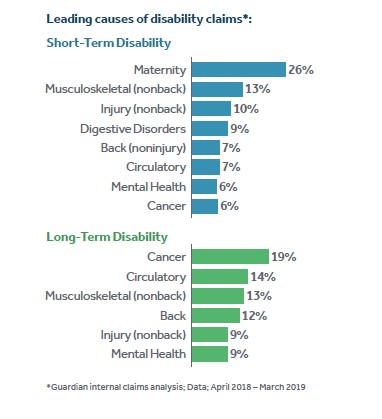

Long term disability insurance quotes - Long term disability insurance on the other hand can last until your retirement. Common elimination periods for individual disability insurance coverage are 30 60 90 180 and 365 days. Because the definition of disability is very strict the disability must be expected to last 12 months or more or result in death 65 percent of all claims submitted are denied.

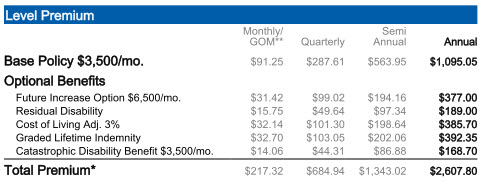

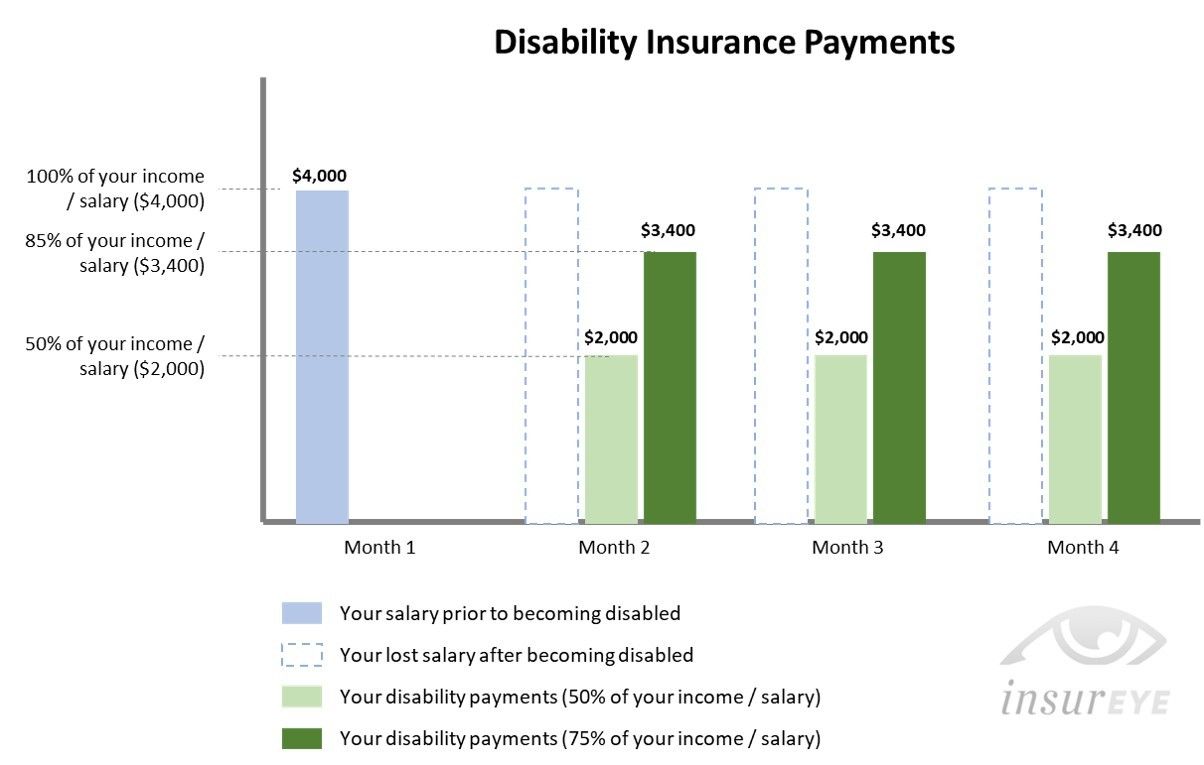

What is long term disability insurance. If you experience a covered illness or injury and can t work for the specified amount of time written in your policy it can pay up to 60 of your monthly salary. Long term disability insurance is a comprehensive flexible solution for people looking to add disability protection that can provide monthly benefits up to 12 000 per month.

Long term disability insurance is a type of income protection that is designed to cover serious injuries and illnesses that keep you out of work for three months or longer. This includes permanent disabilities that leave you unable to return to work. Long term disability insurance is the best option for more people.

It s easy to qualify for compared to social security disability insurance and it lasts for a long time compared to short term disability insurance. Get instant disability insurance quotes from zander insurance endorsed by dave ramsey and learn why it is vital for a financial plan. The disability insurance elimination period also referred to as the waiting period is the time between the onset of a disability and the time you are eligible for benefits.

We will help you to find the lowest disability insurance rates. Long term disability insurance quote get online long term individual disability insurance quotes in one place. There are various types of disability insurance such as short term and long term disability insurance and ways to get coverage like as an individual and as part of a group.

Also known as disability income insurance and income protection insurance it is designed to replace a portion of your monthly earnings while you are disabled. It s the most comprehensive and cost effective form of income protection you can buy. Long term disability insurance is sometimes available through your employer or by purchasing an individual policy.

:max_bytes(150000):strip_icc()/breeze4-98b55285f8014ff9bf03b20682312010.jpg)