Types Of Car Insurance Companies

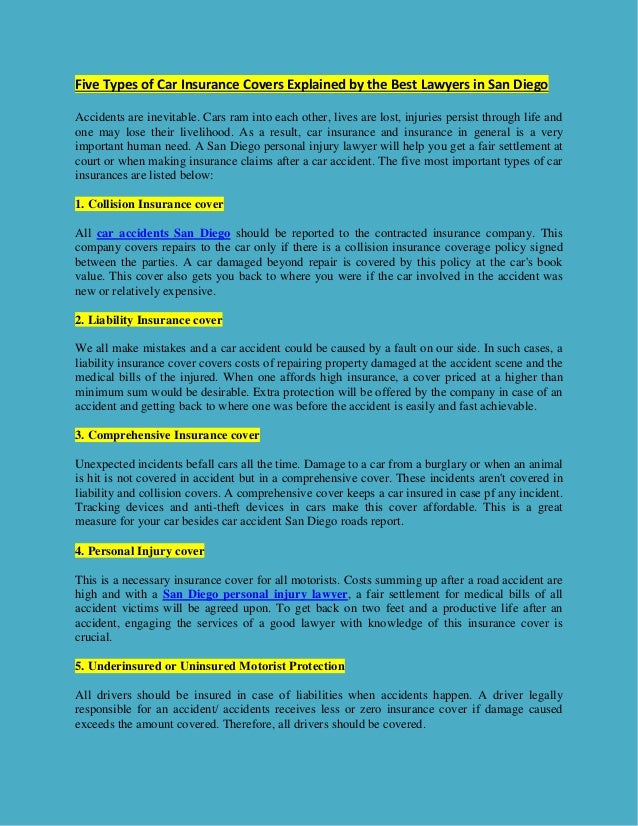

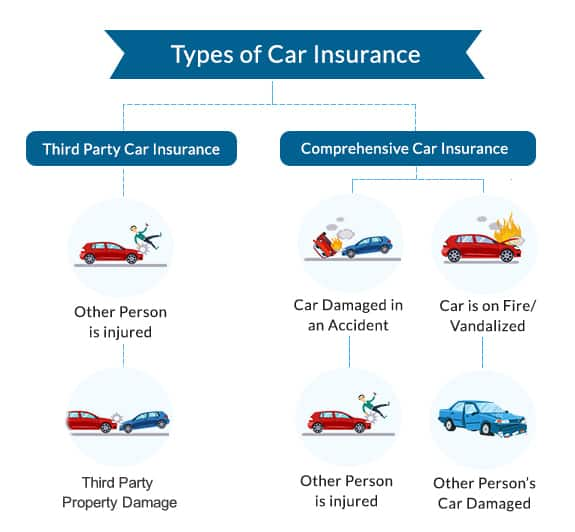

Whereas collision insurance covers damage to your car in an accident comprehensive insurance covers your car from other types of damage such as weather related perils and malicious activity.

Types of car insurance companies - Auto insurance companies might also cover boats or motorcycles. It is a form of risk management primarily used to hedge against the risk of a contingent or uncertain loss. Every year according to the national safety council.

An estimated 38 800 people died in car crashes in 2019 alone. Some of the different types of insurance companies include. The various types of car insurance coverage are available to help protect you your passengers and your vehicle if you re involved in a car accident.

Liability insurance pays for damage and injuries you cause to others. Some of the leading automotive insurance companies are state farm allstate farmers and progressive. If you re buying a new car or shopping for auto insurance you ll likely need to understand the common types of coverage available on a car insurance policy.

Here is a brief explanation of each of these different types of insurance companies and the specific specialty risks insured and other unique attributes. Standard lines excess lines captives direct sellers domestic alien mutual companies stock companies lloyds of london and more. If you re shopping for auto insurance now is a good time to understand the choices available.

Third party this covers other people such as your passengers involved in an accident or damage to other people s property but if your car is damaged or stolen you have to pay for it yourself. Insurance is a means of protection from financial loss. If you re shopping for auto coverage knowing the different types of auto insurance and their coverages is an important step in getting the policy that s right for you.

You don t want to learn later that you didn t buy the right car insurance when you need to make a claim. As a policyholder you might deal directly with an insurance company or with an agent who represents several different companies. Product liability insurance works to protect a business in such a case with coverage available to be tailored specifically to a specific type of product.

An entity which provides insurance is known as an insurer insurance company insurance carrier or underwriter a person or entity who buys insurance is known as an insured or as a policyholder. Here are the most common types of car insurance. Car insurance there are three types of cover.

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)