Umbrella Life Insurance Protection

An umbrella policy picks up where your limited liability coverage ends and best of all umbrella insurance is relatively cheap.

Umbrella life insurance protection - Not all insurers offer excess liability coverage. Umbrella insurance is designed to safeguard you from liability claims that involve your vehicles home or personal property. Multiple injury auto accidents auto.

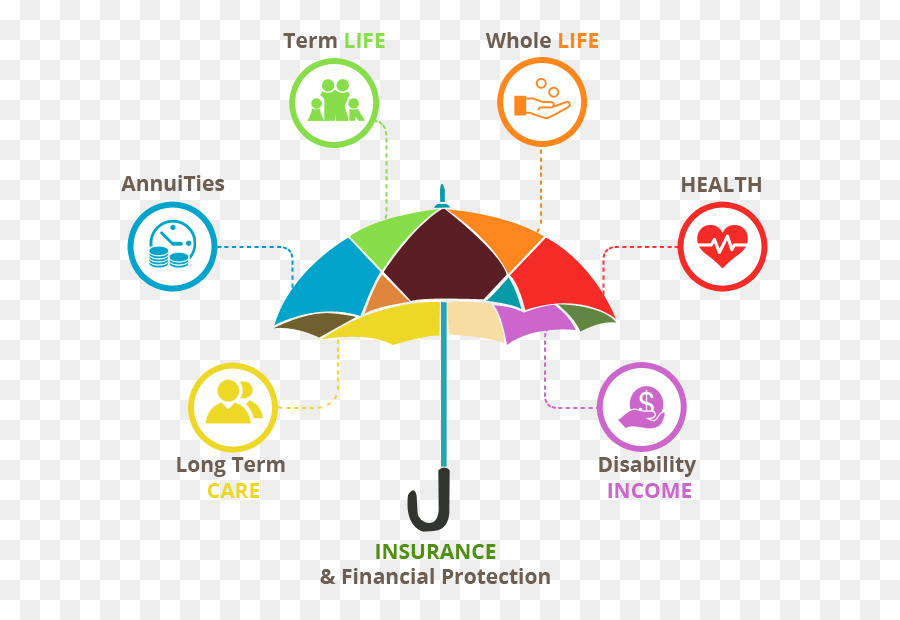

Focuses primarily on liability claims. Business insurance concept and company owner protection as a gear or cog wheel in a lifesaver or life belt as a lifeline symbol of financial risk and security from hazards like flooding. Most commonly umbrella insurance is something you get in addition to either a car insurance or homeowners insurance policy.

Umbrella insurance has an unusual name but it s a simple concept it s an extra liability policy for added peace of mind. Planning to keep your family secure today tomorrow and down the road. Harrington insurance agency inc.

Umbrella insurance is extra liability coverage that goes above and beyond the normal limits of auto homeowners or watercraft insurance and which kicks in after you reach the liability coverage limit on your other insurance policy or policies. Federated s personal umbrella offers additional liability protection over and above your auto and homeowners policies for losses resulting from catastrophic events such as. This type of add on policy helps pay for expensive legal settlements and attorney s fees if you are sued for damages that exceed the limits of your auto and homeowners insurance.

Make sure you re ready for anything life can throw at you with a federated personal umbrella policy. Is an independent insurance agency meaning we do business with multiple insurance companies and compare protection and prices to find the best value for you. The right personal umbrella and life coverage is essential.

Financial insurance and wealth protection with a piggy bank and a red umbrella as a symbol of saving for a rainy day business concept on a white background. Umbrella insurance is sometimes referred to as excess liability protection but these are actually two different types of insurance. Umbrella insurance is a protection provided over and above different primary liability insurance policies written for various businesses and or personal risk protections.

Additional coverage for an extra layer of protection. Umbrella insurance provides a second layer of liability protection. The basics of umbrella insurance.

By definition it covers additional expenses for.