Whole Life Insurance Policy Example

The life insured is the individual named in the policy whose life is covered by the base policy.

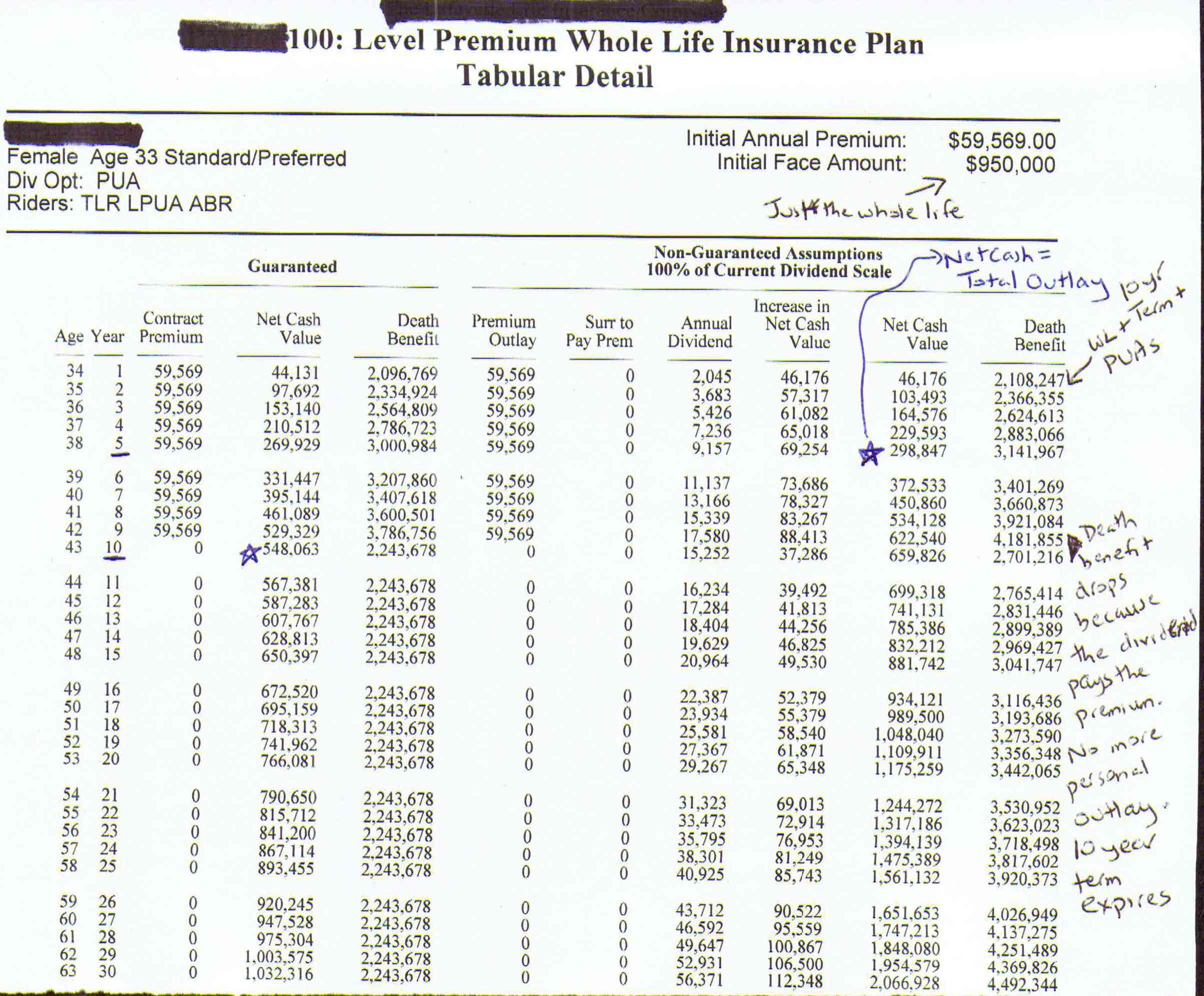

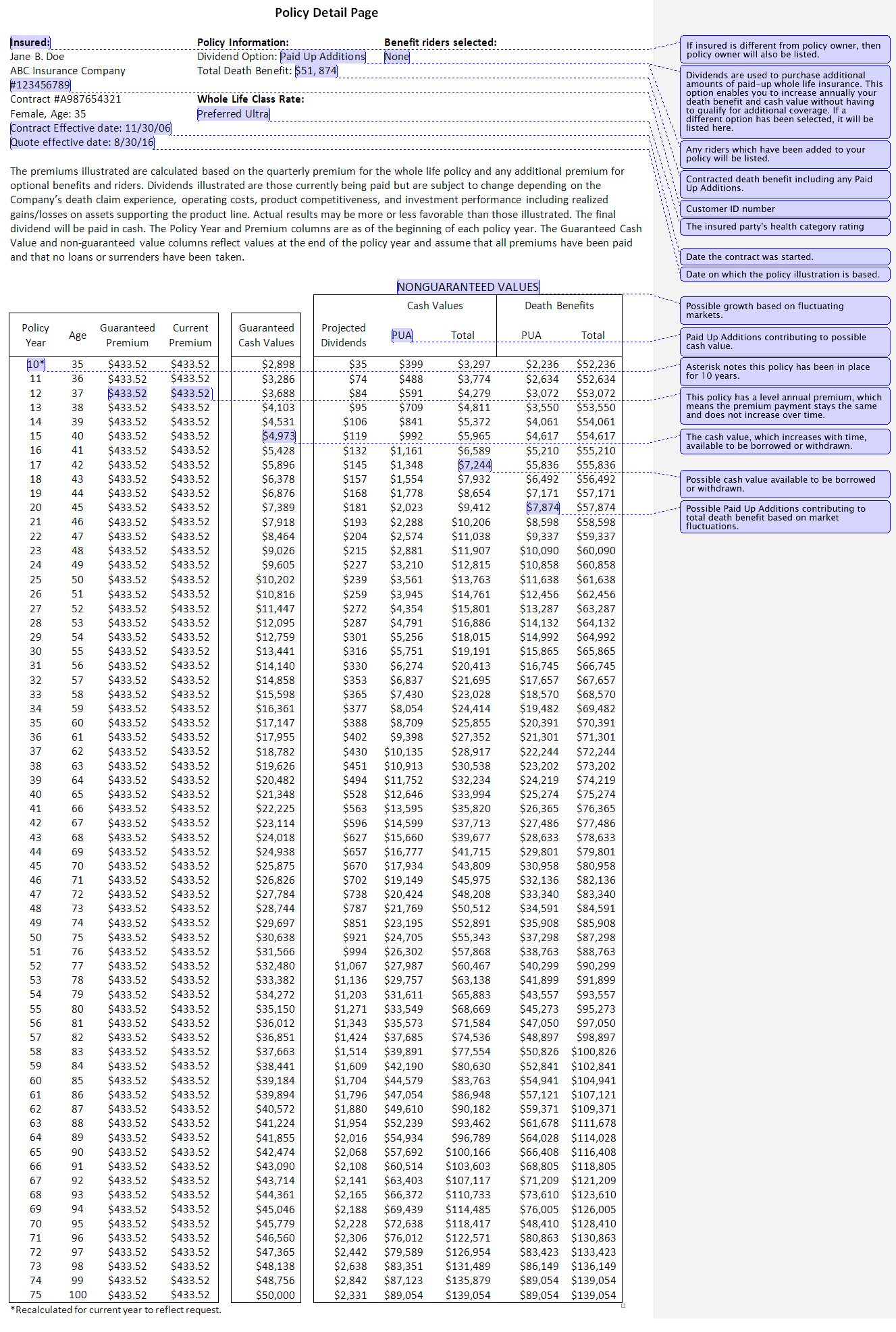

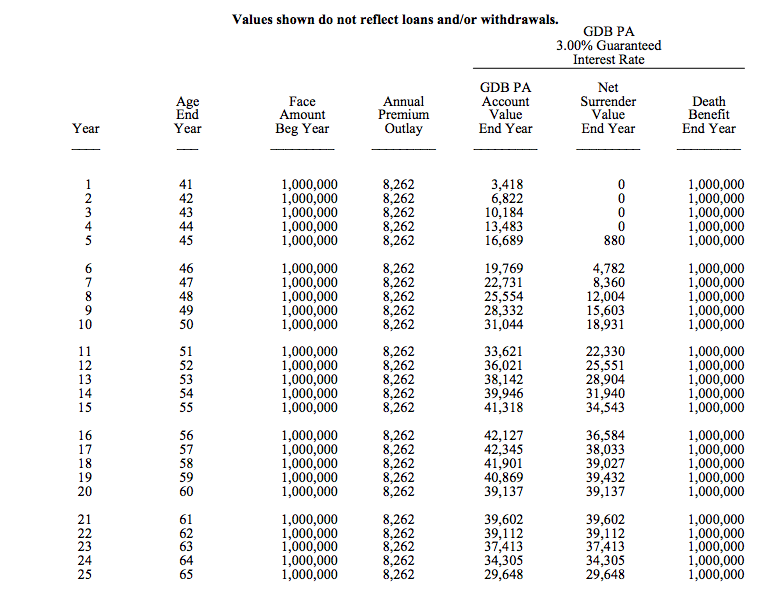

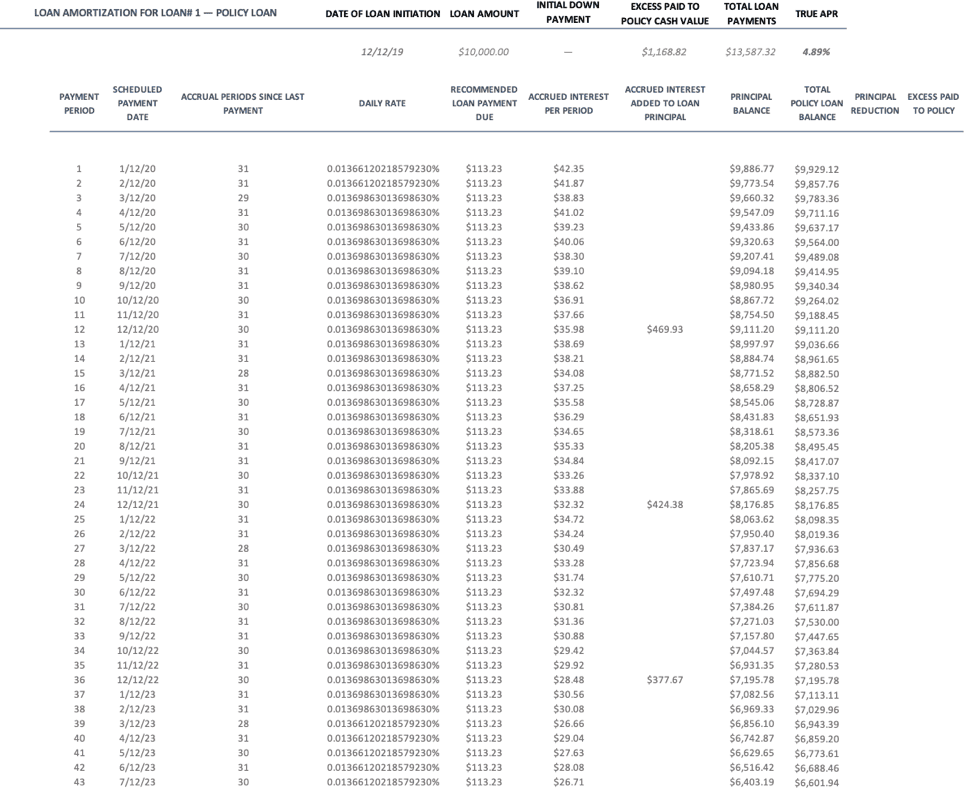

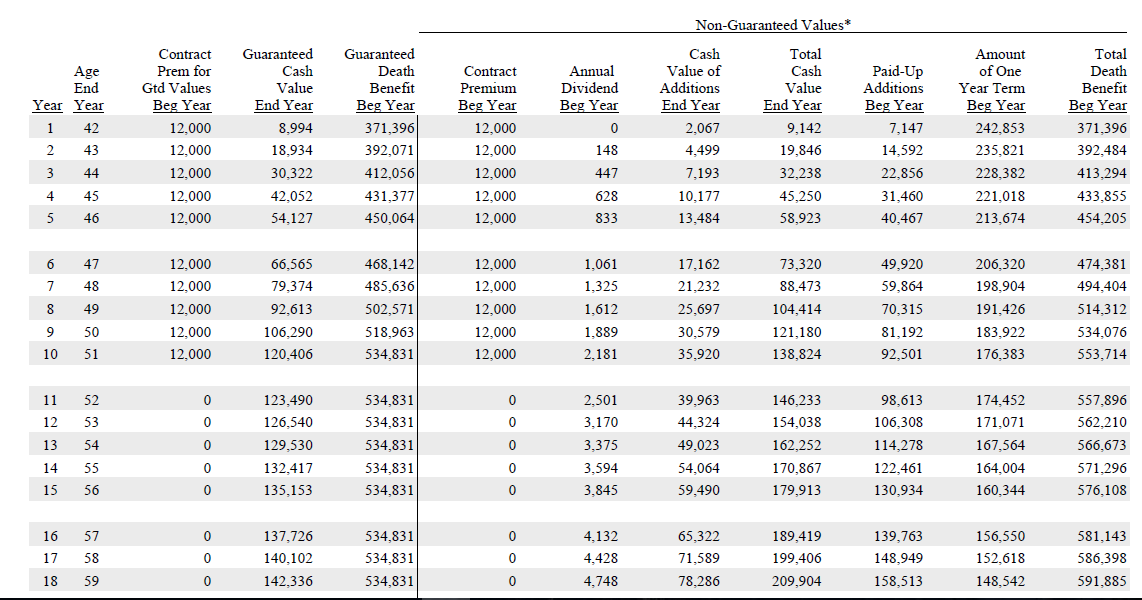

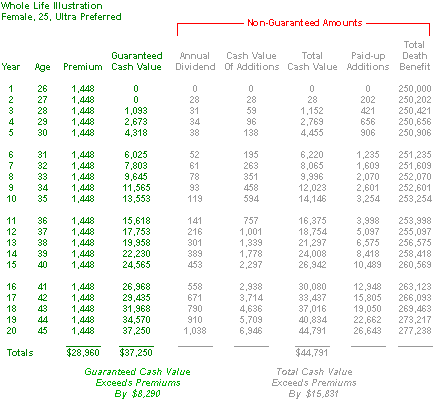

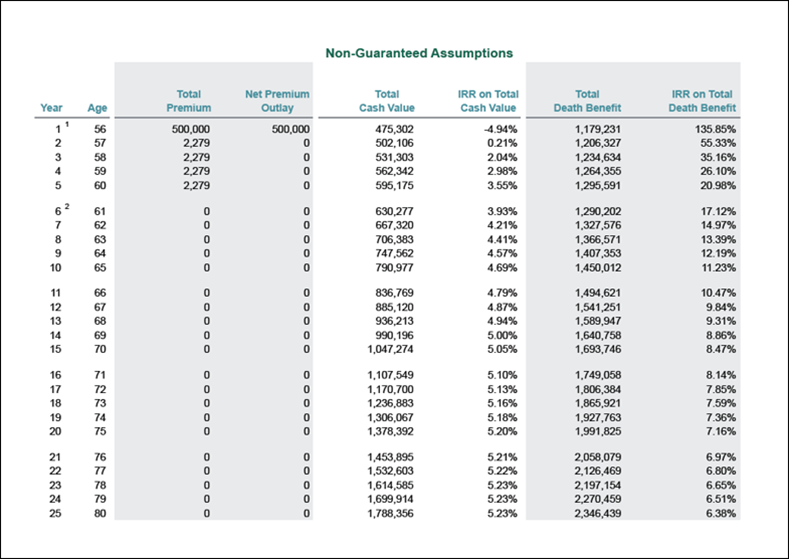

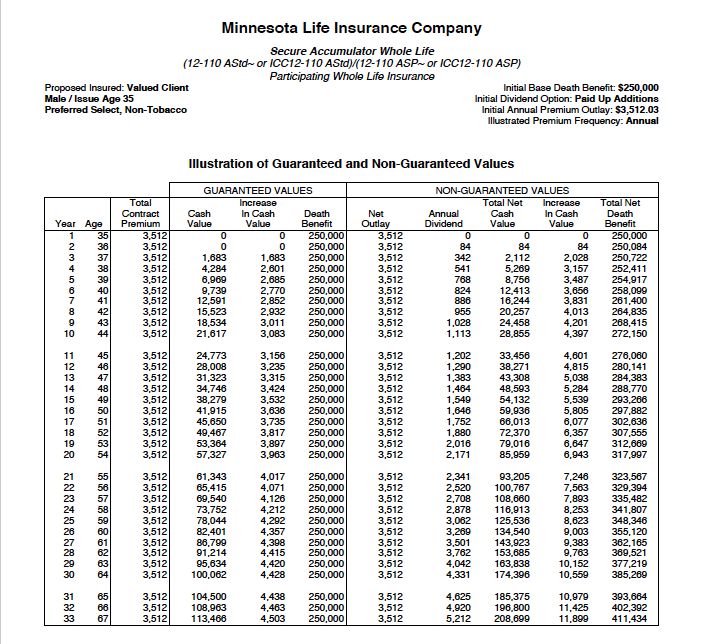

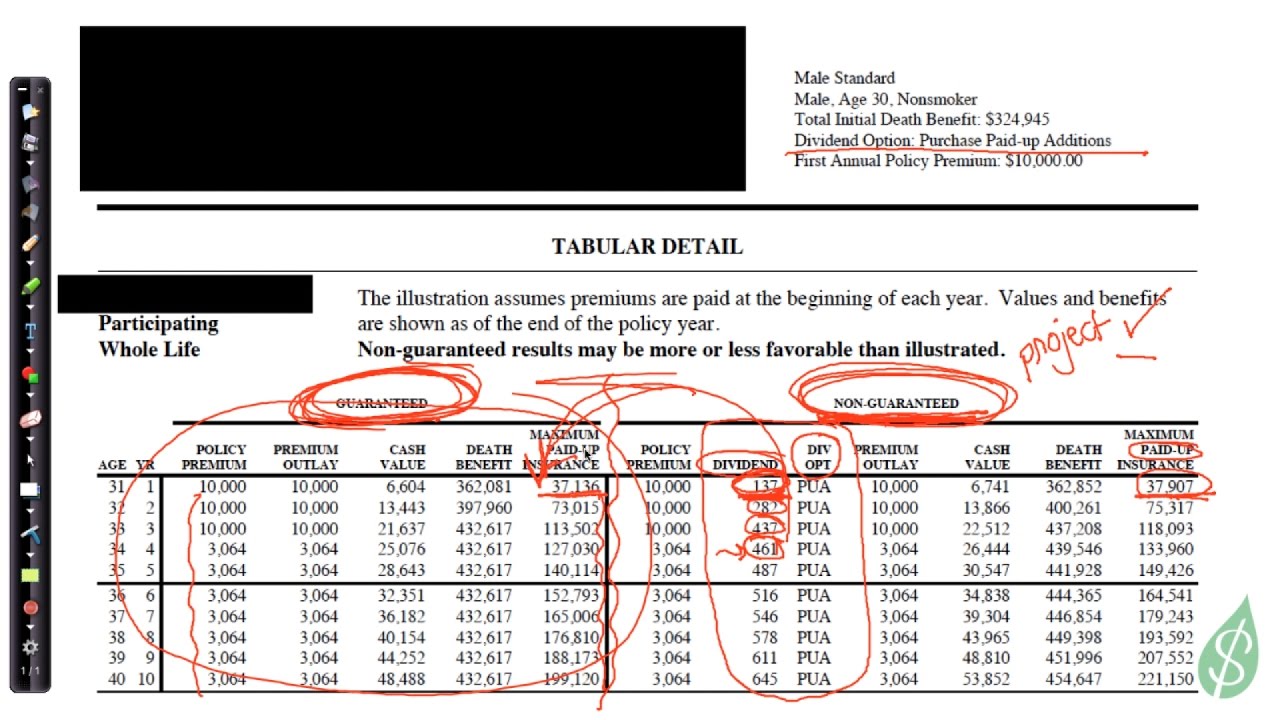

Whole life insurance policy example - Life insurance policies have a policy owner the insured and the beneficiary. This illustration contains both guaranteed and non guaranteed elements. Whole life insurance premiums can be structured to last your entire life or for a set period of time.

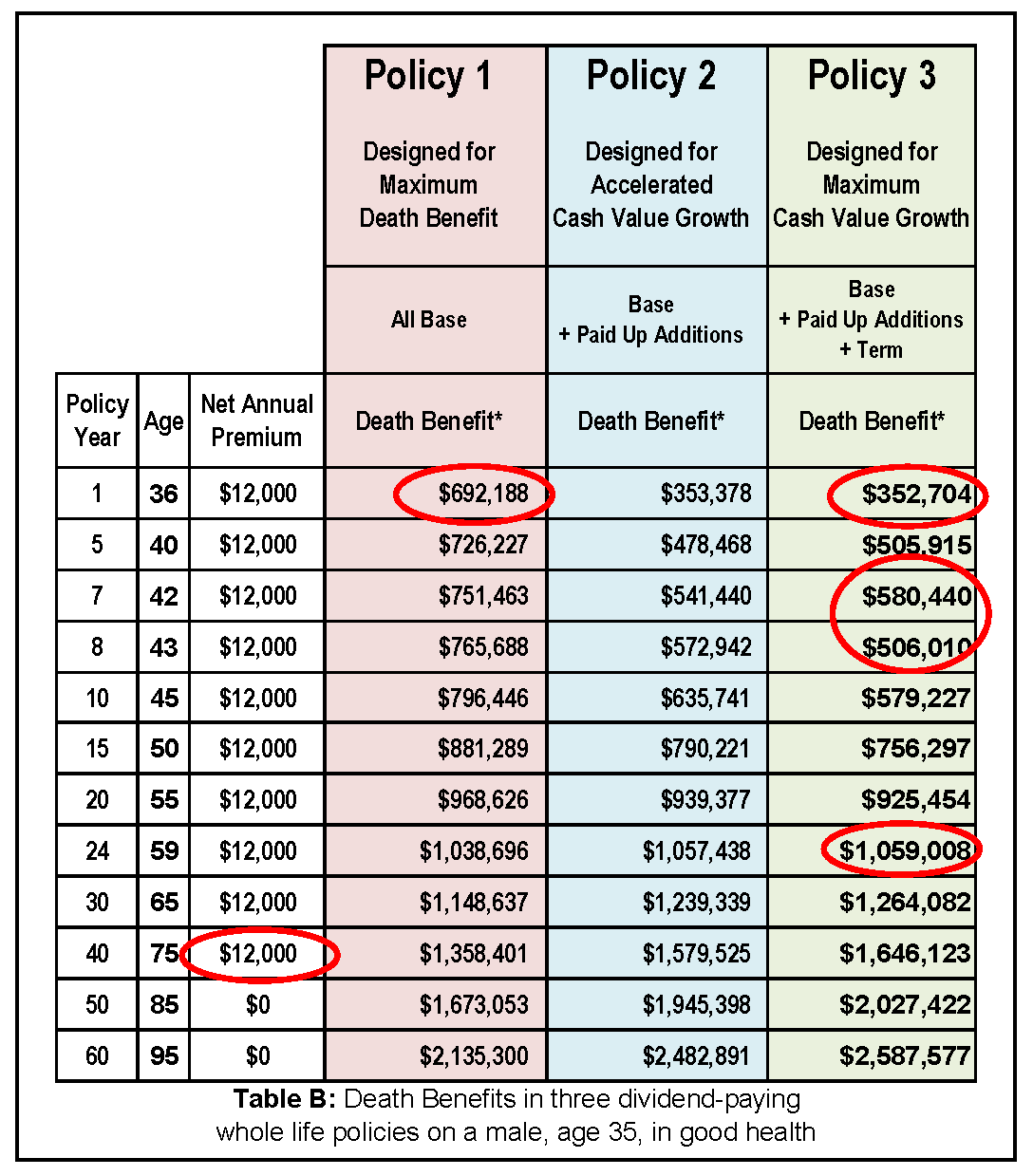

The most obvious difference at least superficially is cost. In the early years the premium will be higher than the cost of term insurance. The policy that answers these questions is a whole life policy.

Signed at milwaukee wisconsin on the date of issue. The owner the insured and the beneficiary. Whole life policy life insured.

The selling of a life insurance policy by a terminally ill person so that person can receive a benefit from the policy while still alive and the purchaser of the policy can receive a. Just like term life insurance beneficiaries exist in a whole life insurance policy. Premiums payable for period shown on page 3.

Global life insurance cancellation department 7634 virginia street columbia md 21097. Whole life policy eligible for annual dividends life insurance benefit payable on death of insured. Here are some examples.

Get whole life while you are young as part of a strategy to maximize benefits or when you are older if you are wealthy and want to do something with all your. Whole life insurance to age 100. Whole life insurance or whole of life assurance in the commonwealth of nations sometimes called straight life or ordinary life is a life insurance policy which is guaranteed to remain in force for the insured s entire lifetime provided required premiums are paid or to the maturity date.

When the owner buys a whole life policy he or she is planning for the policy to last for the insured s whole life. 675432 to whom it may concern. At age 100 your face amount and cash surrender value are the same.

I regret to inform you that i name of policyholder along with life insurance policy have decided to terminate my life insurance coverage effective immediately. They receive the death benefit upon the contract holder s death. Whole life is the most expensive option in the life insurance family of policies and may cost 5 to 10 times more than a term life policy and a little more than a universal life policy.

As a life insurance policy it represents a contract between the insured and insurer that as long. The northwestern mutual life insurance company agrees to pay the benefits provided in this policy the policy subject to its terms and conditions. Only those elements specifically noted are guaranteed.

This policy is paid up at age 100 so you pay premiums until you die or reach 100. The owner pays the same premium each year. The person who has applied for and set up the policy and is paying the premium on it also called the policyholder the owner is the only one who has access to policy information and can change the beneficiaries listed on the policy.