Life Insurance Usa Cost

Health insurance costs in the united states are a major factor in access to health coverage.

Life insurance usa cost - The health care cost per person covered by a policy will be set according to their age with rates increasing as the individual gets older children up to the age of 14 will cost a flat rate to add to a health plan but premiums typically increase annually beginning at age 15. An early form of life insurance dates to ancient rome. Health insurance companies determine the set of policies offered and the cost of coverage based on.

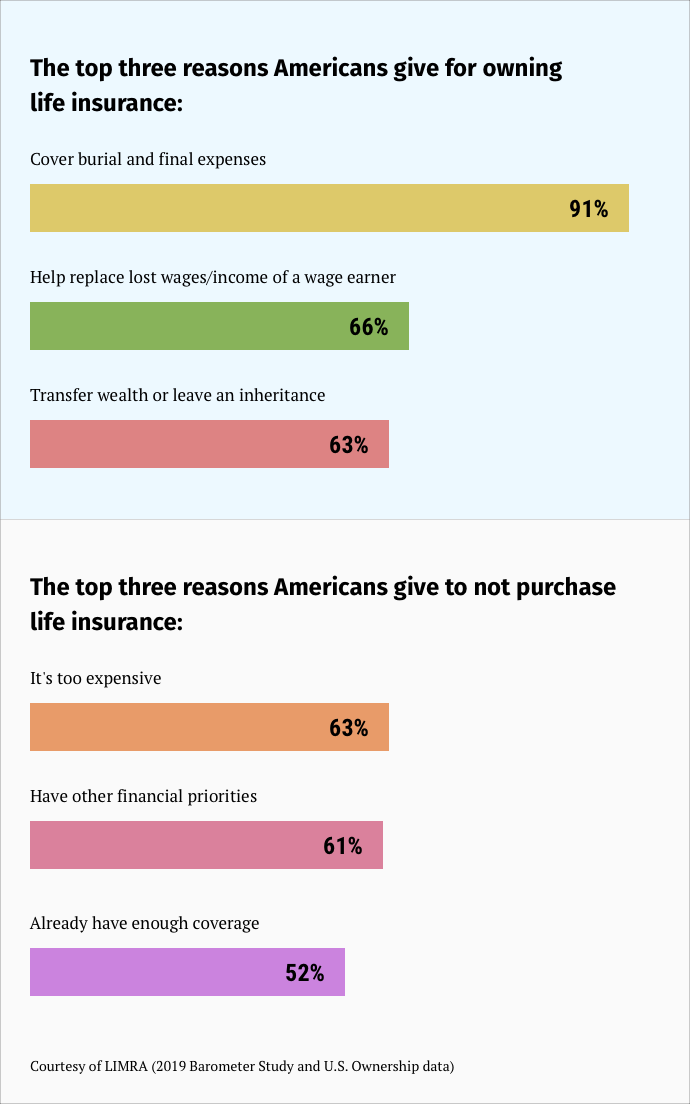

With some policies the possibility of a future increase in life insurance cost exists but generally the cost you pay is consistent throughout the period of time that you will be paying for the insurance plan. Each member made an annual payment per share on one to thr. The average life insurance costs are affordable for most families.

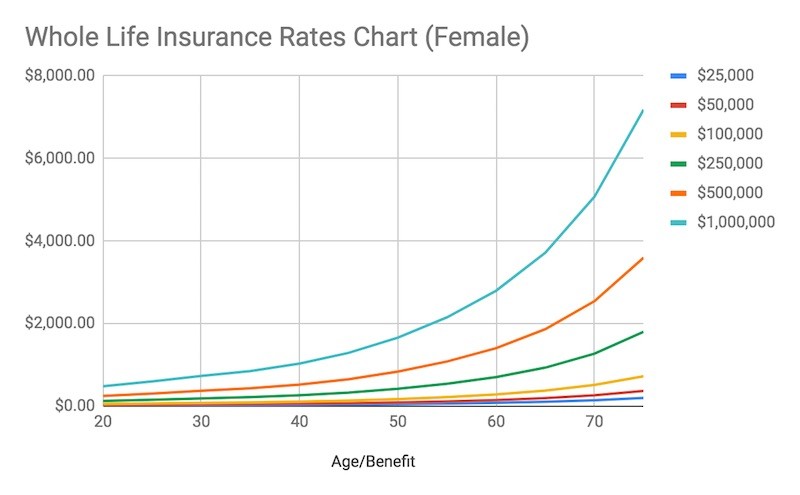

Stranger originated life insurance or stoli is a life insurance policy plan that is held or funded by a person that has no connection to the insured person. The cost of your premium is based on age and personal behaviors such as smoking and overall health conditions. It s possible to get life insurance after 70 but your options will be limited and you can expect to pay substantially more for coverage a person in their 80s can expect to pay more than 1 000 a year for a 10 000 or 20 000 final expense or guaranteed issue policy.

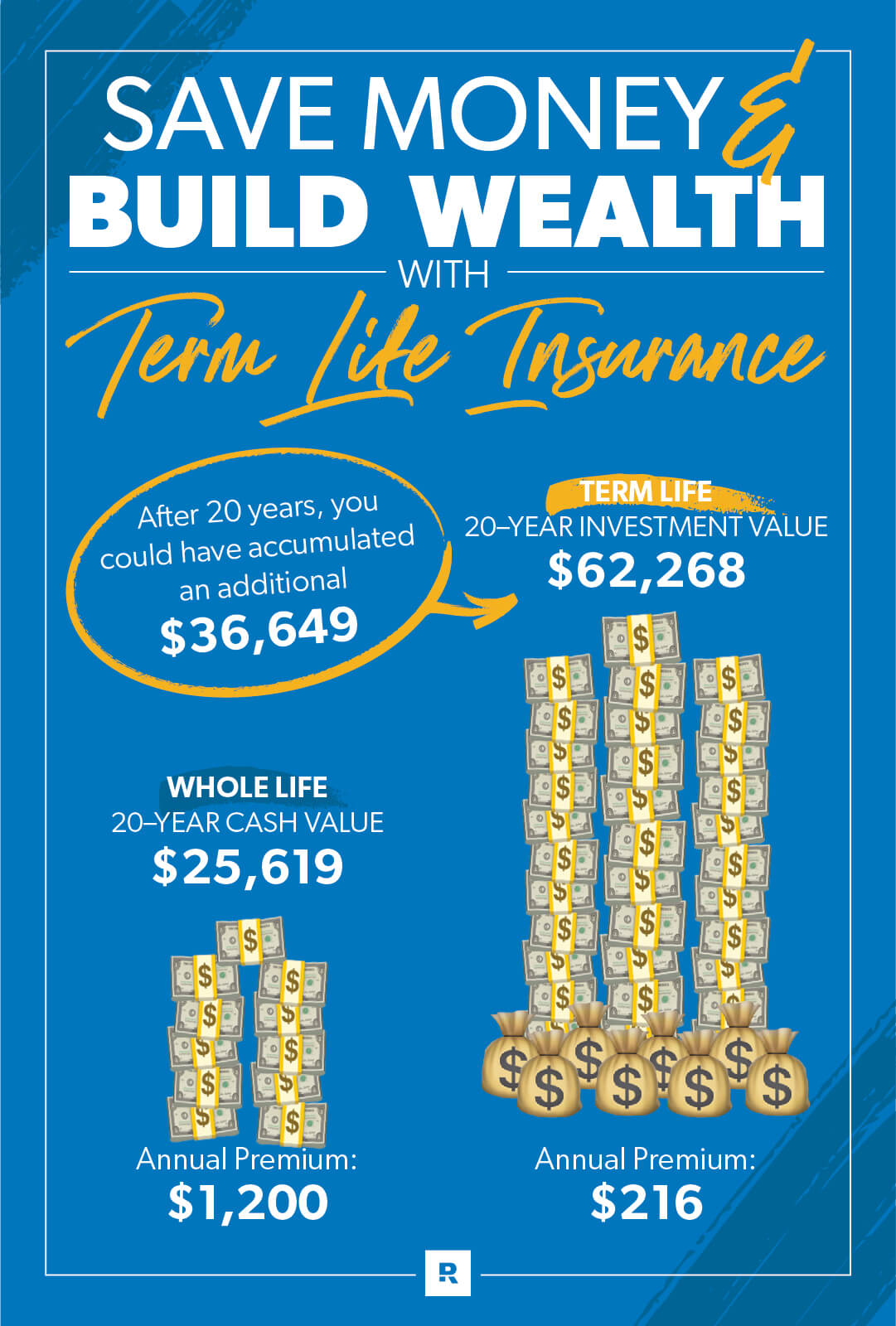

Best term life insurance. Specifically the release says that the average premium for the second lowest cost silver plan is decreasing by 4 on healthcare gov from 2019 to 2020 for a 27 year old. You should think of this number strictly as a baseline your own rates for life insurance will change depending on your age the insurer you choose and the amount of.

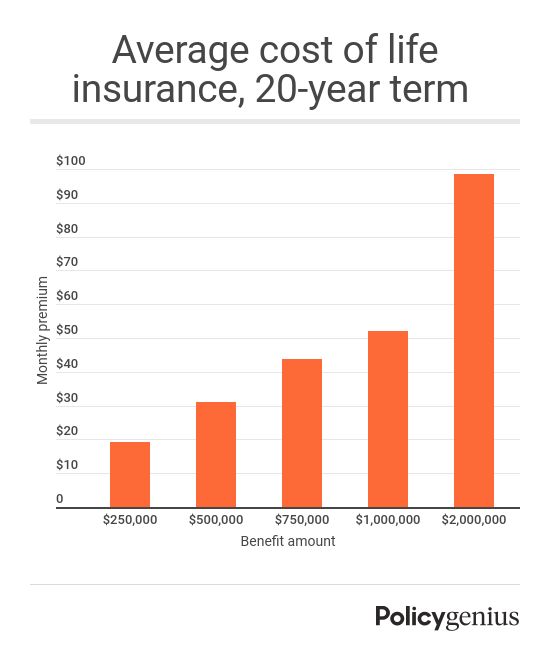

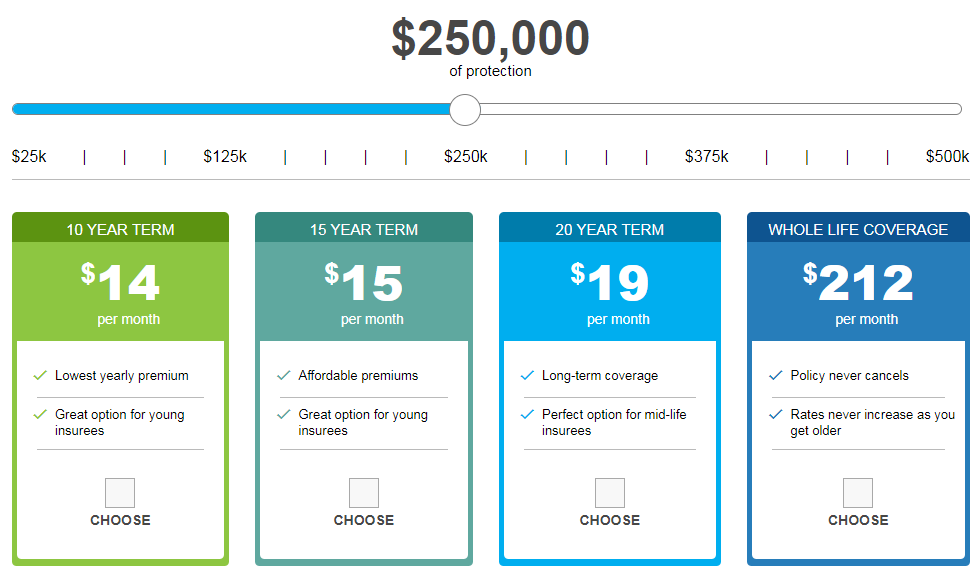

Cost of life insurance for people over the age of 70. Term life insurance rate. We ve found that the average cost of life insurance is about 126 per month based on a term life insurance policy lasting 20 years and providing a death benefit of 500 000.

For the average consumer in the usa term life insurance quotes are far less expensive. The rising cost of health insurance leads more consumers to go without coverage citation needed and increase in insurance cost and accompanying rise in the cost of health care expenses has led health insurers to provide more policies with higher deductibles and other limitations that require the. The plan holder generally pays a costs either regularly or as one round figure.

Burial clubs covered the cost of members funeral expenses and assisted survivors financially the first company to offer life insurance in modern times was the amicable society for a perpetual assurance office founded in london in 1706 by william talbot and sir thomas allen. So youve made the decision to apply for life insurance as the next important step in your financial and estate planning you know what kind yo.